The Dow Jones Industrial Average reached new highs in December 2025 while investors simultaneously grappled with concerns about AI-driven market sustainability.

This bifurcation reveals something worth watching. Major indices climb even as companies like Oracle and Broadcom face scrutiny over their AI performance metrics and future outlooks. The S&P 500, now heavily weighted toward artificial intelligence companies, moves with particular sensitivity to these shifts. Investors rotate out of technology behemoths when AI valuations raise questions, creating ripples across the broader financial ecosystem.

The numbers tell part of the story. Global private AI investment hit $109.1 billion in 2024. Enterprise spending on generative AI jumped from $11.5 billion in 2024 to $37 billion in 2025. AI-related investments accounted for 51% of global venture capital deal value in Q3 2025.

Yet the market is searching for something more concrete than projections. Investors want tangible evidence of AI-driven productivity and revenue growth, not just potential. This creates an environment where some AI stocks experience meteoric rises while others see significant sell-offs, contributing to volatility even amid overall market gains.

What’s Happening in Metro Atlanta

Georgia reports 8.6% of its workers face potential AI-related job displacement, slightly below the national average. Atlanta’s fintech sector integrates AI into financial technologies rapidly. Healthcare AI initiatives, driven by Georgia Tech and the state government, focus on accessible care through AI-augmented decisions. The city’s logistics and manufacturing operations explore AI for predictive maintenance and supply chain optimization.

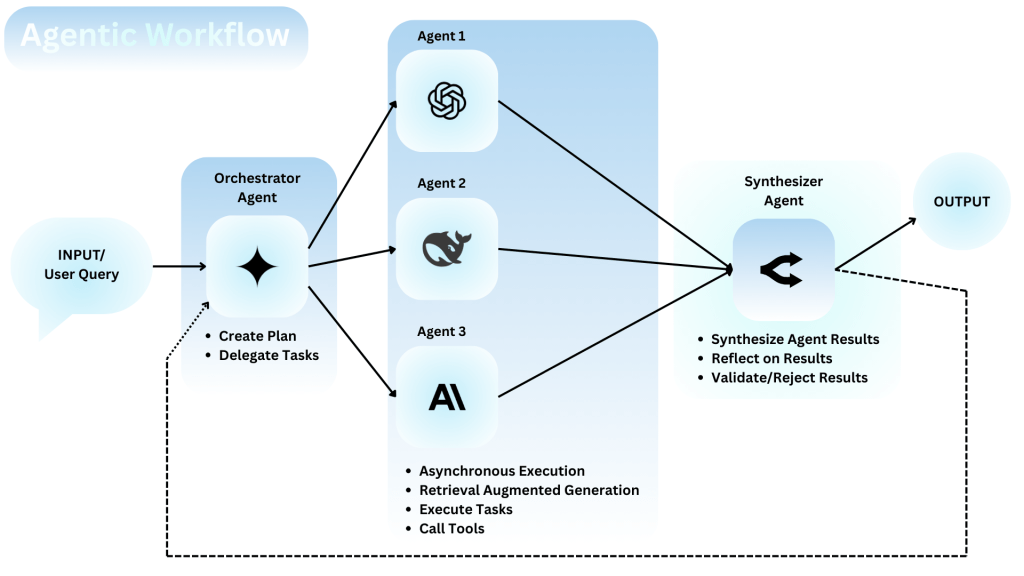

Behind these market movements, businesses are reimagining operational processes. Companies move beyond automating simple tasks to integrating AI into core functions. The focus shifts toward what analysts call hyperautomation, where multiple technologies combine to streamline processes across organizations.

The gap between AI investment and scaled enterprise integration remains notable. While some sectors lead adoption, others lag, creating disparities in efficiency and competitive advantage.

If your organization is exploring how automation fits into daily operations without adding complexity, we’re here to help you think through practical next steps that match your actual capacity and goals.